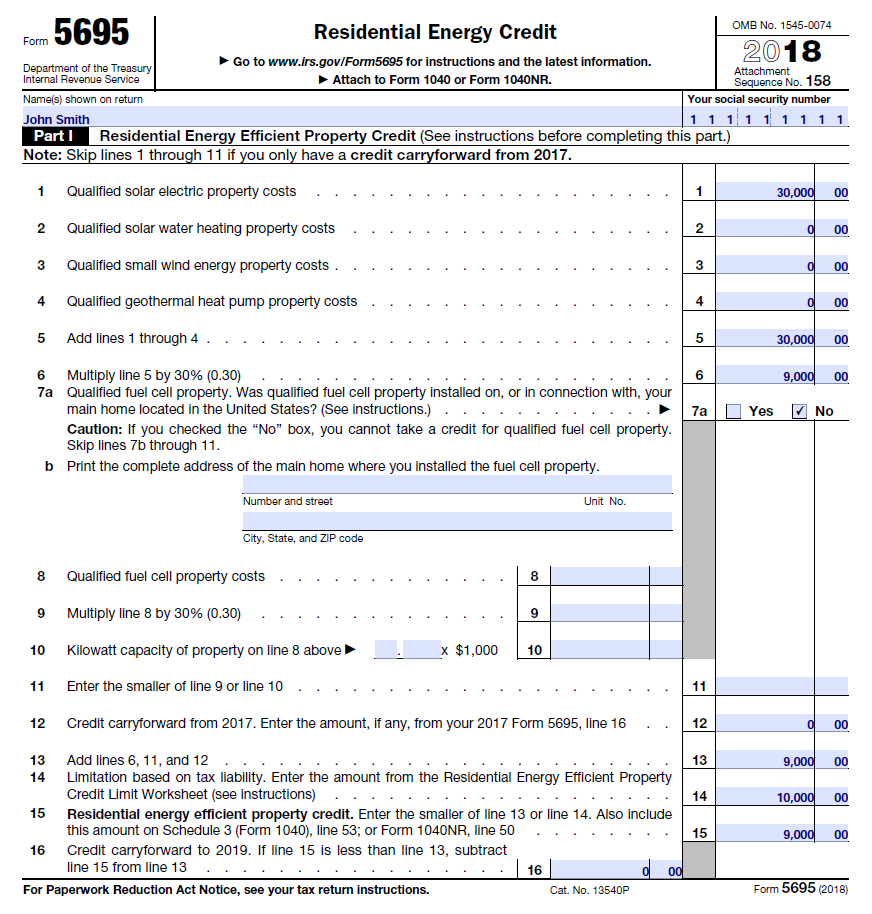

One of the best incentives that comes along with a solar energy system is the solar investment tax credit itc which allows individuals who purchase a solar system to deduct 30 percent of the cost of the system from their federal taxes.

Solar tax credit 2018 irs.

February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019.

You calculate the credit on the form and then enter the result on your 1040.

Individual income tax transmittal for an irs e file return.

To claim the credit you must file irs form 5695 as part of your tax return.

In addition to the credit form in most cases you may also need to file form 3800.

To file your federal solar itc you will need two irs tax forms along with.

If you file a form 1040 or 1040 sr schedule c you may be eligible to claim the earned income tax credit eitc.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

About form 8453 u s.

5 minutes last updated on august 27 2020.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

For installations complete in 2019 the tax credit is 30 of the cost.

To claim a general business credit you will first have to get the forms you need to claim your current year business credits.

Our step by step guide to using irs form 5695 to claim the federal solar tax credit.

Irs summertime tax tip 2016 25 august 29 2016 certain energy efficient home improvements can cut your energy bills and save you money at tax time.

Use these revised instructions with the 2018 form 5695 rev.

The residential energy credits are.

About form 4255 recapture of investment credit.

Recent legislation has retroactively impacted the 2018 instructions for form 3468 10 feb.

These instructions like the 2018 form 5695 rev.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

Filing requirements for solar credits.

Page last reviewed or updated.